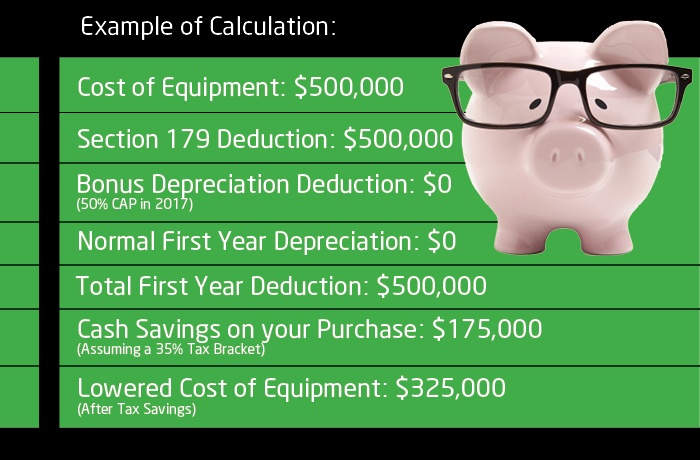

Time is flying by, before we know it 2018 will be rolling in. Take advantage of Section 179 of the IRS Tax Code for your used or refurbished capital equipment. This fabulous financial incentive allows you to purchase medical imaging equipment and deduct the full purchase price totaling up to $500,000. But, the equipment must be financed or purchased during the 2017 tax year. See the example below:

Calculate your own numbers here!

Bonus Depreciation will phase down to 40 percent in 2018 and 30 percent in 2019.

Remember to get the full benefit of Section 179 your medical imaging equipment must be financed and in place by midnight December 31, 2017.

Now, before you think, “Yeah, but I can wait until next year and still get the tax break”—don’t count on it. Those folks at the IRS tend to change the Section 179 tax break standards from year to year, and usually NOT in your favor.

As Abraham Lincoln said” Things may come to those who wait, but only the things left by those who hustle”. In today’s world, it just as easily applies to refurbished medical imaging equipment that often times gets purchased quickly when it hits the market.

To view the specifics about Section 179 visit here!

Atlantis Worldwide buys and sells diagnostic imaging equipment along with providing complete project management services for your medical imaging needs. Please contact us today!

Some blogs you may have missed:

- Selling Your Used Medical Imaging Systems vs Trading-in

- Twitter is Alive with Tweets about Urgent Care Centers

- Service Contracts for Imaging Systems: Penny Wise and Pound Foolish?

- Radiologists, Healthcare & Social Media

- Should your business lease or buy medical imaging equipment?

Meet the author: Vikki Harmonay